Uncategorised

Uncategorised

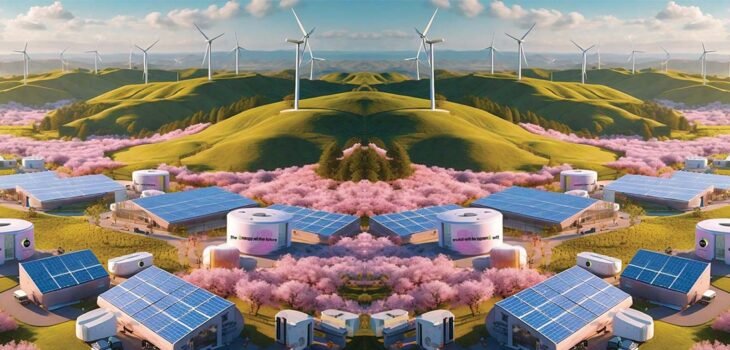

New Power System Domination

New Power System Domination New power systems dominated by variable renewables are set to become the new energy reality for nearly every country within the next three decades. We forecast that by 2050, wind and solar will supply almost 70% of the world’s electricity. By then, global electricity consumption will have doubled compared to today. This significant increase in variable renewables will present many challenges and create new market dynamics for grids worldwide. These are some of the key findings in our special report on New Power Systems, part of DNV’s Energy Transition Outlook series. Our report helps you understand the impact of this new power reality on national economies, energy security, and the pace of the energy transition. By 2050, we also find that:

• Global grid infrastructure is set to double to meet surging electricity demand

• Electricity will be more than 90% decarbonized

• Household energy expenditures will decline to 75% of 2021 levels in Europe and 50% in North America

#renewableenergy#pv#ev#bess#ess#co2

by the courtesy of DNV.

Is the Battery Energy Storage Solution an economical method for saving Energy, as of today available facility?

LFP is the economical BESS

LTO is the costly BESS

Air Cooling BESS is accepted

Liquid Cooling BESS accepted